CHAPTER 25.0 COSTS AND TRIP RATES OF RECENT HOUSEHOLD TRAVEL SURVEYS

Note: Significant components of this chapter come from The Hartgen Group’s report, Household Travel Survey Costs and Trends, 1988 – 2009. The paper is prepared by David T. Hartgen and Elizabeth San Jose. The original report can be accessed online through the Hartgen Group’s website, http://www.hartgengroup.net/Projects/National/USA/household_travel_summary/2009-11-11_Final_Report_Revised.pdf

Are you planning a travel survey for your region? Learn what others have experienced.

- How big a sample is typical for cities like mine?

- What do surveys cost, for cities like mine?

- Do costs vary geographically?

- Are costs increasing over time? How fast?

- How much do ‘activity’ or ‘trip’ formats cost?

- What cities have recently done 2-day surveys?

- What is the cost for a second day?

- What cities have recently done weekend days?

- What cities have used GPS or web-based designs?

- What are typical trip rates for cities like mine?

- Are trip rates increasing or decreasing over time?

- What is the range of average trip rates, for cities like mine?

25.1 Overview

Travel surveys are a staple of transportation planning. They are conducted regularly by regional planning agencies and states, sometimes in conjunction with larger national surveys. Their primary uses are in describing local travel patterns, updating travel models, evaluating major project proposals and monitoring travel trends.

Because of their wide communality, several reviews of travel surveys have been conducted, and several manuals of practice prepared. The University of MinnesotaUniversity of Minnesota). Stopher et. al. summarized the state of the practice in travel surveys, concentrating on survey methodology, question format and categories, and data processing-coding (Stopher et. al., 2008). The Travel Survey Committee of TRB has recently initiated the wiki-edited development of a revised survey manual (Transportation Research Board, 2009) building on Stopher’s work. In a 1996 report (Stopher, 1996), Stopher and Metcalf synthesized the methods used in 55 travel surveys conducted primarily in the 1970s and 1980s. Also in 1996, Cambridge Systematics Inc (Cambridge Systematics Inc., Travel Survey Manual, 1996). prepared a detailed manual on the conduct of various travel surveys; the Appendix A to this document discusses cost estimation principles, quotes a widely-noted $ 100/household rate, and gives examples of cost calculations for external surveys. In a slightly later review, TMIP (DOT and EPA, 1997) summarized the characteristics of 55 largely US travel surveys. In 1995 Axhausen (Axhausen, 1995) prepared an international ‘survey of surveys’ summarizing the question structure of a large number of primarily European-Australian travel surveys, but including about 15 from the US. Richardson et. al. (Richardson et. al., 1995) provide guidance on travel survey design; and an earlier USDOT overview (U.S. Department of Transportation, Federal Highway Administration, 1973) provides documentation of survey methods from the 1960’s. As useful as these documents are, however, none provide basic empirical cost information needed to efficiently plan surveys. As newer methods and an increasing focus on ‘activity’ surveys emerge, it is useful to have a periodic assessment of the cost of these surveys and an overview of their results. has recently established a repository for travel survey data and reports which contains information on about 73 surveys (Center for Transportation Studies,

This brief report is intended to summarize, in shorthand form, the costs and primary results from about 115 travel surveys, in a range of metropolitan areas from the largest down to very small regions, and about 17 ‘statewide’ surveys. Most of the surveys are from the US, but a few are from Canada and overseas. They cover many (but certainly not all) surveys conducted over a 20-year period, from 1988 to 2009. The review focuses on ‘administrative’ data for survey planning purposes:

- Costs and ‘unit’ (per completed sample) costs.

- Cost trends over time

- Cost estimation models.

- Sample sizes.

- Survey types.

- Household and person trip rates.

- Trip rate trends over time.

- Contact names and emails.

This review is not intended for detailed planning or questionnaire design, or detailed results comparison. For that, the University of Minnesota website is a useful resource, with primary documents. Rather, it is intended to provide basic planning information needed to begin the process of survey design, and to provide contact names for particular survey features that may be of interest.

This review is being updated regularly, and therefore the authors would appreciate other surveys, and of course revisions, being brought to their attention.

25.2 Results

The following graphics and brief points summarize the primary findings of the review. These findings are preliminary, since they are continually being updated.

25.2.1 Descriptive

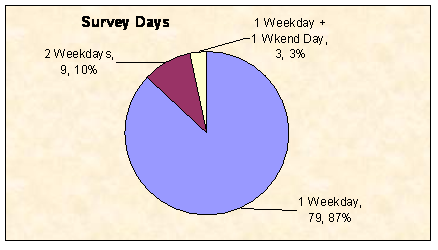

Most travel surveys continue to be 1-day weekday surveys, although a few (9 of 91 reporting) are for 2 weekdays, and 3 are for weekdays and one weekend day. However, most of the surveys not reporting this statistic (about 24) are likely to be 1-day weekday surveys.

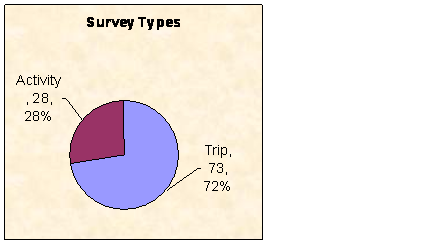

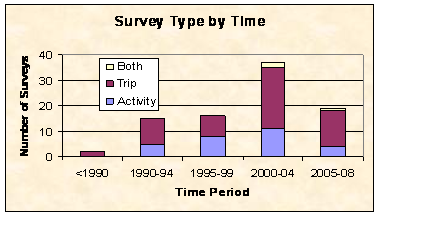

‘Activity’ format surveys are about 1/3 of the total but are increasing relatively over time; about 28 surveys were reported as ‘activity’ focused, and about 73 as ‘trip’ focused.

25.2.2 Nominal Costs

Comparative survey costs are difficult to determine since surveys vary widely in length, content, planning and processing. We used here, the contract survey costs, which normally include design, sampling, training and conduct, and also typically include documentation, some coding and processing but not modeling.

Based on our review, we estimate the average cost of a survey at about $ 487,000, implying a total 2-decade survey budget of about $ 194.8 million for 400 regions, or about $ 9.7 million annually. This is somewhat higher than Stopher and Metcalf’s estimate of $ 7.4 million annually, in 1996.

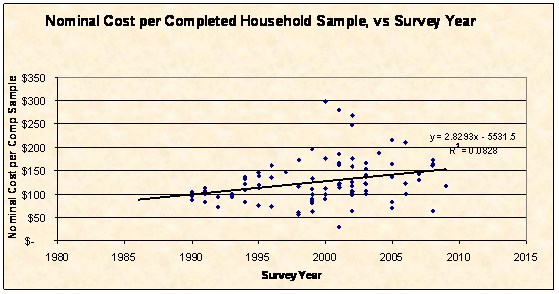

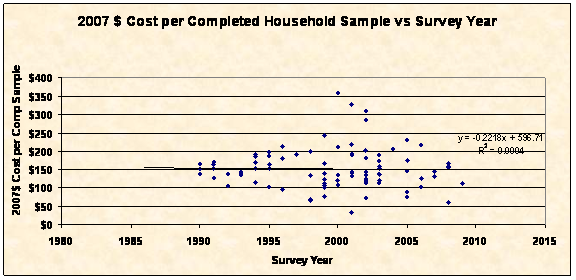

The nominal (year of survey) unit costs for household travel surveys have been rising over time, from about $ 105 per completed sample in the late 1980’s, to an average of about $ 150 per completed sample, recently. However, many surveys cost considerably more than the average, and the spread of the data is substantial. During this period, survey costs have increased about $ 2.83 per sample per year. However, this increase includes inflation.

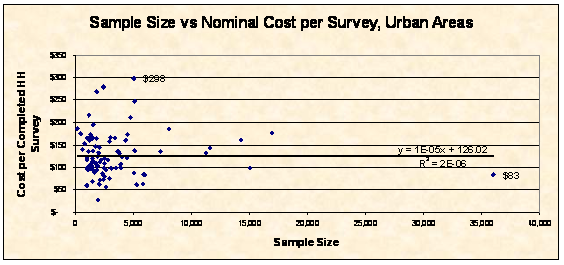

Survey costs decline very slightly with increasing sample size, a very small ‘economy of scale’.

25.2.3 Survey Costs Adjusted for Inflation

However, when adjusted for inflation (i.e., what the survey would have cost if conducted in 2007, using national CPI growth rates), survey costs are estimated to average about $ 529,000 in 2007 dollars, implying a ‘going forward’ annual national cost of travel surveys of about $ 10.6 million annually.

The average 2007 cost per completed sample has actually declined slightly over the past several decades, from about $ 155 per completed sample in 1990 (in $2007) to about $ 151 in 2008, a decline of about $ 0.22 per year over the past two decades. However many recent surveys conducted since 2000 have cost much more than the average, some as much as $ 300-$350 per sample.

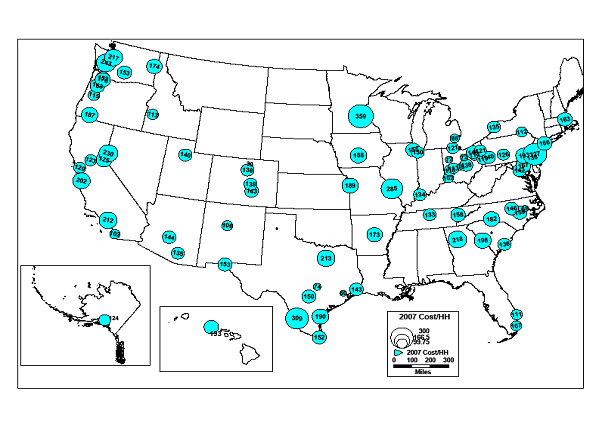

The geographic distribution of unit survey costs (2007$) is shown in the following figure. While there is clearly some slight tendency for ‘mid-US’ surveys to cost less, per completed sample, than ‘coast State’ surveys, the effect is probably not significant. Nevertheless, the tendency of large-city ‘coastal’ cities to cost more, per unit, cannot be overlooked. More research is needed to determine whether this is a ‘cost-of business’ effect, or perhaps something related to survey length or other factors.

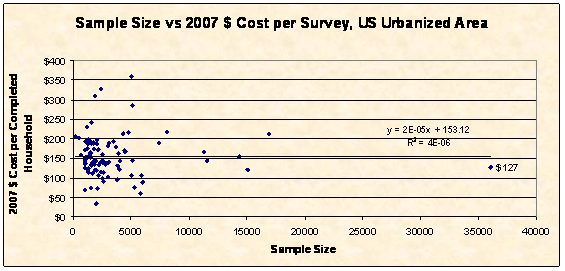

Unit costs for surveys decline with increasing sample size. For surveys of about 500-600 samples, costs in the range of $ 140-160 per completed sample might be typical, while for larger surveys, in the 1000-sample range, costs range from $ 100-$ 250/sample. Generally, costs per sample decline by about $0.02 for each increased sample.

However when adjusted for $ 2007 prices, the relationship is flatter; per-sample costs decline about $0.01 for each added sample. However, both relationships are quite weak.

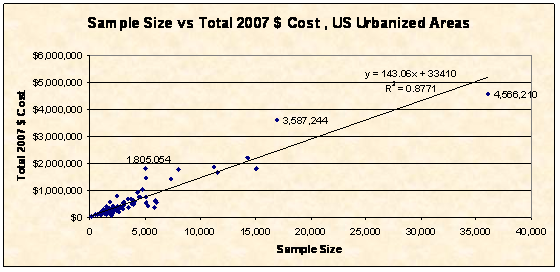

As expected, total survey costs ($2007) increase linearly with sample size. The following graphic suggests that the increase is about $ 143 per completed sample, with a ‘base’ cost of about $ 34,000. So, a 1000-completed sample survey might be expected to cost about $ 177,000 or about $ 177/completed sample.

The following two ‘2007$ cost models’ have been developed from the 78 surveys for which full data is available:

2007 $ Total survey cost = - 30440

+ 11.74 Pop07K (regional population)

+ 133.90 Sample Size

+ 93716 (Number of Survey Days: 1, 2, ..)

- 75718 (“1” if “activity” format)

N = 78

RSQ = 0.90

2007$ Unit survey cost (per completed household)

= 121.11

+ 0.0014 Pop07K

- 0.0007 Sample Size

+ 29.71 (Number of Survey Days: 1, 2, ..)

- 20.33 (“1” if “activity” format)

N = 78

RSQ = 0.06

While the first model is stronger, it is an ‘aggregate’ model based on total costs. The second model, estimating per-sample costs, may be more useful for planning.

A simple example will illustrate the use of these models. Consider a proposed household survey, one-day, activity format, 1000 households, for a region of 1.5 million persons. The estimated cost is:

Total Cost = - 30440 + (11.74)(1500) + (133.9)(1000) + (93716)(1) –(75718)(1)

= $ 139,068, or $ 139.07 per completed sample.

Unit cost = 121.11 + (0.0014)(1500) – (0.0007)(1000) + (29.71)(1) – (20.33)(1)

= $ 131.89, or $ 131,890 for 1000 samples.

The effect of extra days’ in these models is interesting. In the first, the addition of a second day would add about 67% to the total cost. In the second model, adding an additional day would add about 23% to the total survey cost.

25.2.4 Household Trip Rates

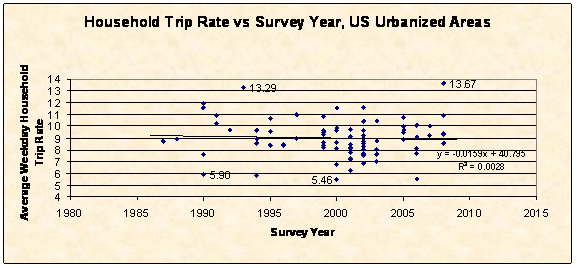

Average weekday household trip rates have been quite stable, on average, over the past 2 decades, averaging about 9 trips per household, with many surveys, however, reporting somewhat higher or lower rates. Household trip rates seem to have fallen slightly over the past 20 years, from about 9.1 in 1990 to about 8.9 in 2008. However, the variation in rates is very large, and this may be merely the effect of variation in regional demographic and survey procedures, along with generally declining household size.

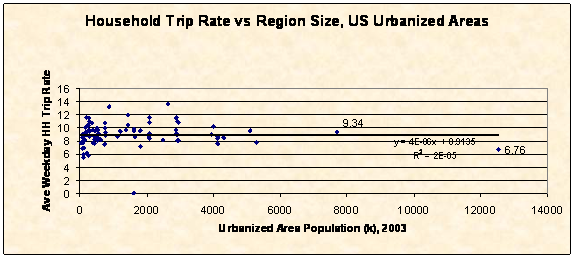

There is some evidence that trip rates are slightly lower in larger regions. Trip rates seem to average about 8.9 for small regions, declining to about 8.75 for regions with 15 million persons. This effect is therefore quite small, about 1.7% difference (-0.15) between the smallest and largest regions. If true, it might be a combination of density and possibly demographic (income and household size) effects. The spread of the data is substantial.

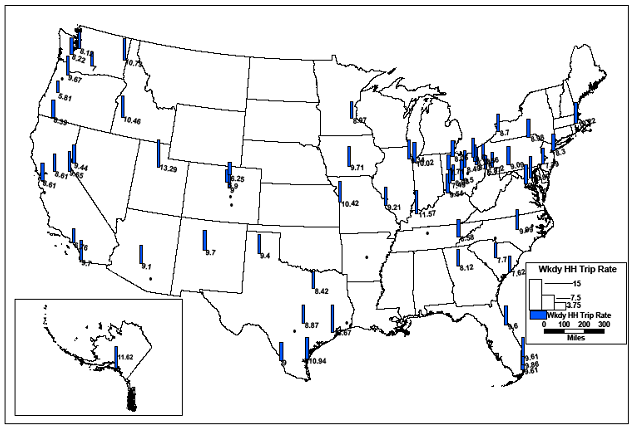

While household trip rates vary quite widely, there is no obvious evidence that this is a geographic phenomenon. The following figure shows average trip rates for cities reporting across the US. The figure suggests that average trip rates seem to be a function of regional demographics rather than US location.

25.2.5 Person Trip Rates

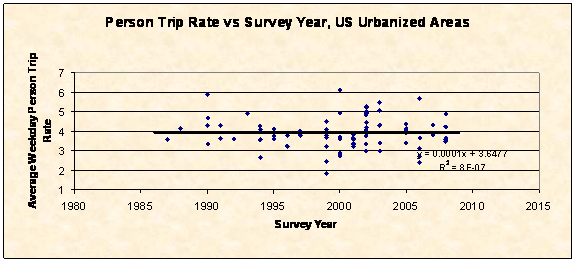

Average weekday person trips also seem to be largely stable over time. Over the past 2 decades, the average weekday person trip rate has been essentially flat, at about 3.90 – 4.00 trips per person.

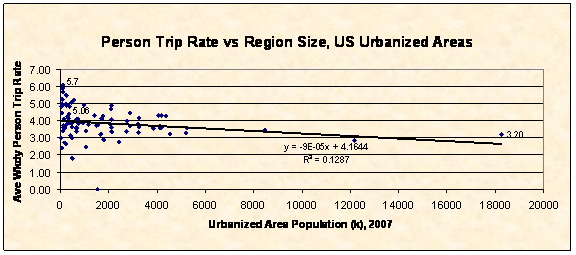

Person trip rates seem to be somewhat more sensitive to region size than household trip rates. On average, person trip rates decline from about 4.16 in small regions to about 3.2-to-3.6 in very large regions. They seem to decline slowly with increasing region size. This might be the result of smaller family sizes in large regions (imposing, on average, fewer travel-related activities), possibly different demographics (income), or possible density effects producing higher walk-bike shares which are often not surveyed in travel surveys. However, as in most of the relationships, the model is weak with considerable variation.

The following table summarizes basic administrative information and costs for the surveys in the study. We appreciate the efforts of many MPOs, consultants and others in providing this information. We would appreciate being informed of other surveys not listed, or new surveys underway, particularly those using innovative survey methods. We hope to update this listing regularly.